What Is the IS-LM Model in Economics

Written by MasterClass

Last updated: Oct 12, 2022 • 4 min read

The IS-LM model is a way to explain and distill the economic ideas put forth by John Maynard Keynes in the 1930s. The model was developed by the economist John Hicks in 1937, after Keynes published his magnum opus The General Theory of Employment, Interest and Money (1936).

Learn From the Best

What Is the IS-LM Model?

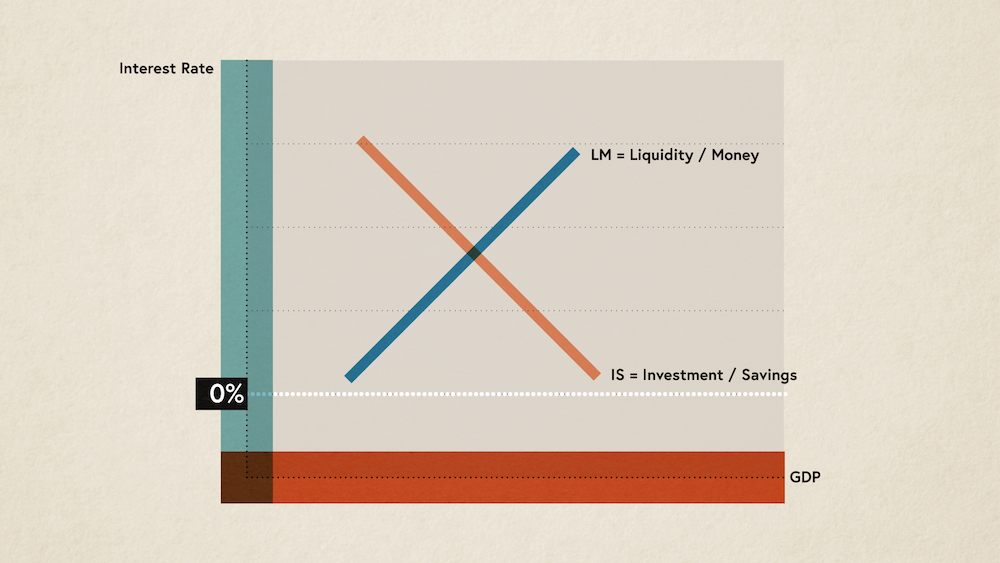

The IS-LM model appears as a graph that shows the intersection of goods and the money market. The IS stands for Investment and Savings. The LM stands for Liquidity and Money. On the vertical axis of the graph, ‘r’ represents the interest rate on government bonds. The IS-LM model attempts to explain a way to keep the economy in balance through an equilibrium of money supply versus interest rates.

The IS-LM is also sometimes called the Hicks-Hansen model.

Breaking Down IS-LM

In order to gain a full understanding of how the four components work together, it is important to first understand what each component means on its own.

Investment

In macroeconomics, an investment is defined as a quantity of goods purchased in a period of time that are not consumed or used in that time. Investment increases as interest rates decrease.

Savings

Savings, sometimes known as deferred consumption, is income that is not spent. As interest rates fall, savings also fall, as most households take advantage of lower interest rates to make purchases.

Liquidity

Liquidity refers to the demand for and amount of real money, in all of its forms, in an economy. Those who part with liquidity, in the form of saving or investing, are rewarded through interest payments or dividends.

Money

Money is a any verifiable record or item that can be used as a means of paying for goods and services.

Putting IS-LM Together

The IS curve describes the goods market. The IS curve slopes down and to the right, representing the fact that as interest rates fall, people and businesses try to invest more in long-lasting goods like houses, cars, and equipment. When interest rates fall, families also tend to put less away for savings and spend more on consumer goods. Thus the effect of a falling interest rate is an increase in GDP through greater investment and less personal savings.

The LM curve describes the money market. The LM curve slopes up and to the right. It represents what economists call the money market. As the economy expands, banks and other financial institutions need funds to support the extra investment. To get those funds, they encourage consumers to deposit more of their cash into longer term deposits like certificates of deposit or bonds.

The IS relationship and LM relationship create opposing forces. On the one hand, a falling interest rate tends to cause the economy to expand. On the other hand, an expanding economy causes interest rates to rise. Where the two curves meet, the forces are balanced and the economy is in equilibrium.

How the Fed Impacts IS-LM

The Federal Reserve can move the LM curve by printing money. The more money the Fed prints, the less aggressively banks have to raise interest rates to attract deposits. This causes the LM curve to shift outward.

The lines will now cross at a new point—one where the interest rate is lower and the economy is larger. In this way the Fed has the power to control the level of GDP.

Although the Fed can increase the strength of the economy by printing money, that comes at the cost of a higher rate of inflation. Higher inflation causes the IS curve to shift inwards. This causes interest rates to rise again and the economy to slow.

If the Fed is not careful, its actions can backfire and lead to an economy with high rates of inflation but not very high GDP growth.

Why the IS-LM Curve Is Flat at Zero

Another tactic the Fed can use to increase the amount of money circulating in the economy is to lower interest rates. Lower interest rates make it easier for households and businesses to borrow money from banks. The loans that banks make inject more money into the economy and allow it to recover from the recession.

When interest rates hit zero, however, increases in the money supply have no effect. Households and businesses no longer have an increased incentive to take out loans. The extra money sits in banks without being spent. This is the reason the LM curve is flat at zero. Economists call the inability of interest rates to go below zero the zero lower bound.

The Pros and Cons of the IS-LM Model

The IS-LM model is a controversial economic tool. It has a number of detractors, including the creator Hicks himself, who said that the model is best used “as a classroom tool” rather than in any practical application. There are, however, pros to using the model.

Learn more about the benefits and drawbacks, below.

Pros:

- The model is commonly used to explain Keynesian macroeconomics on a basic level.

- It is a good introduction to and first approximation of policy-making.

Cons:

- Does not take into account a huge variety of factors the come to play in the modern economy, such as international trade, demand, and capital flows.

- Takes a simplistic approach to fiscal policy, the money market, and money supply. Central banks today in most advanced economies prefer to control interest rates on the open market—for example, through sales of securities and bonds. This model cannot account for that should not be used as the sole tool in determining monetary policy.

- Does not reveal anything about inflation or international trade, and does not provide insight or recommendations toward formulating tax rates and government spending.

The IS-LM model is a great way to explain Keynes’s ideas about how monetary systems, markets, and governmental actors can work together to drive economic growth. However, as a practical model to advise on fiscal or spending policy, it falls short.

Learn More

Get the MasterClass Annual Membership for exclusive access to video lessons taught by the world’s best, including Paul Krugman, Doris Kearns Goodwin, Ron Finley, Jane Goodall, and more.