How to Calculate the Break-Even Point: Break-Even Analysis Formula

Written by MasterClass

Last updated: Oct 12, 2022 • 4 min read

A company owner needs to know how to price their products appropriately to cover costs and earn a profit. You do this by figuring out your company's break-even point and using it to do a break-even analysis of your enterprise.

If you don't know how much it costs to make and sell your products versus how much your products produce in revenue, it becomes difficult to generate earnings and sustain profitability.

Learn From the Best

What Is the Break-Even Point?

A break-even is the point at which a company has neither a profit nor a loss—the total costs and total revenues (or total sales) are equal.

Why Is It Important to Know Your Break-Even Point?

An analysis of a break-even point will help a company determine the following:

- Are unit costs are too high for the amount of sales needed to cover those costs?

- Is the per unit selling price appropriate to cover costs, or is it too low—requiring you to sell far more units than is realistic?

- Is your per unit selling price high enough for you to recover your costs in a reasonable timeframe?

- Is your per unit selling price high enough to cover your variable costs while leaving enough left over to cover your fixed costs and provide you with an adequate profit? (This is called your contribution margin or contributing margin.)

- How does your cost and pricing structure compare with your industry's averages?

All of this information will help you decide whether your business is sustainable. If not, a break-even analysis will tell you how to adjust your fixed and variable costs, per unit selling pricing, contribution margin, and level of sales to make it so.

How to Do a Break-Even Analysis

A break-even analysis tells a company the minimum number of units it must sell to generate the total dollar revenue needed to cover all costs. A break-even analysis is done before you launch a business. It helps you determine whether your business is viable from the outset.

Because a break-even analysis will tell you your optimal sales price and sales volume, it also helps you figure out if your plan is realistic in the current market environment.

You can also do a break-even analysis for an already-operating business. Such an analysis will tell you your margin of safety based on your existing revenues and costs. You can also analyze different pricing structures to determine what sales levels you need to cover your costs and generate a reasonable profit. That can help you assess the sales efforts you need to mount to be successful.

Fixed vs. Variable Costs

Before calculating your break-even point, it is crucial to know the difference between fixed costs and variable costs.

- Fixed Costs: These are costs that don’t change based production level or output. They include fixed expenses like rent, property taxes, depreciation, research and development, marketing unrelated to revenue, administrative costs, computers, and software.

- Variable Costs: These are expenses that vary depending on your business’s level of output or production. They include variable expenses such as raw materials, labor, fuel, utilities, and sales commissions.

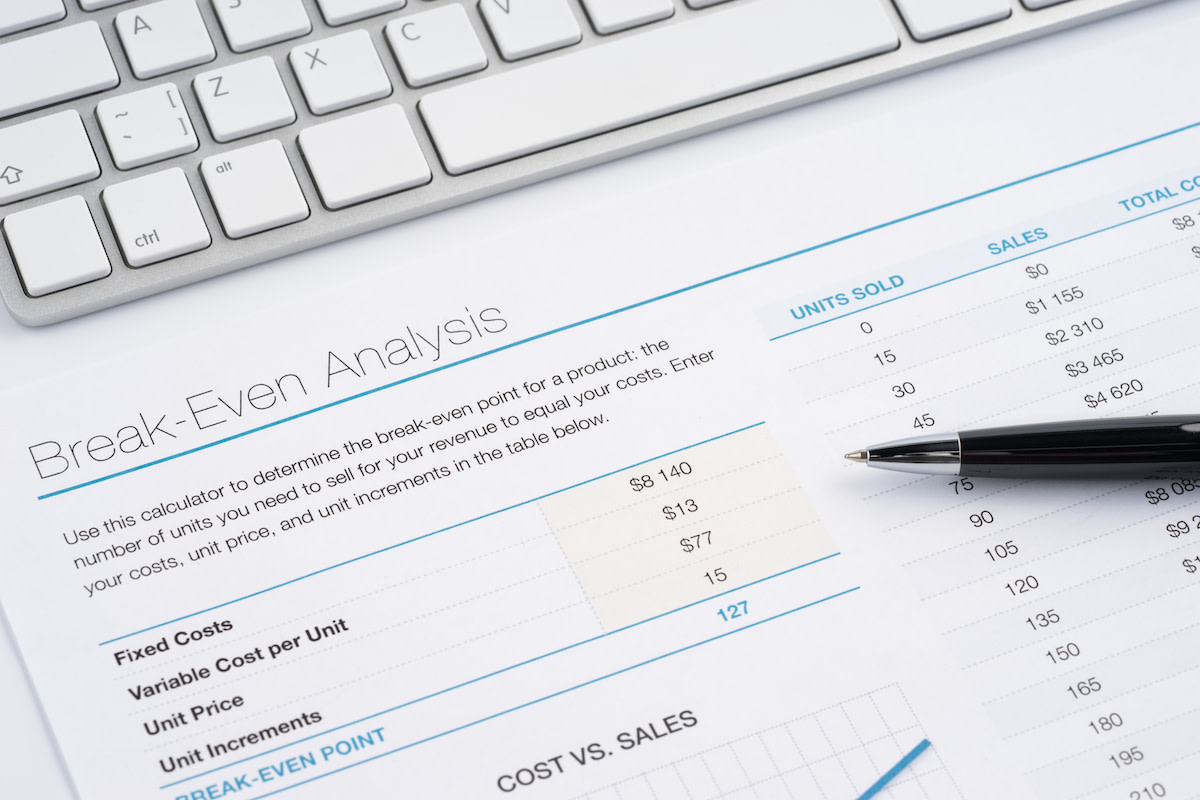

How to Do a Break-Even Analysis: Break-Even Point Formula

Fixed Costs + Variable Costs = Total Sales

You can also determine your variable cost per unit by dividing your total variable costs by the number of units you produce:

Total Variable Costs ÷ Number of Units = Variable Cost per Unit

Once you set your per unit price, you can arrive at your contribution margin, or contributing margin. This will tell you how much money you have after accounting for the costs of producing your product.

Price per Unit - Variable Cost per Unit = Contribution Margin

You will need to pay your fixed costs out of the contributing margin. Whatever’s left is your net profit.

Use the contributing margin to calculate your break-even volume, or BEV, which is the total number of units you must sell to cover your fixed costs. This is also called the break-even quantity. Use this formula:

Fixed Costs ÷ Contributing Margin = Break-Even Volume (BEV)

How to Apply the Break-Even Point to Your Business

Once you know your break-even volume, you can use it to answer some basic questions about your business.

- Is my BEV too high?

- Can my company sell this many units in the time I need to cover my fixed costs?

- Do I need to raise my per unit price to lower my BEV?

- Do I need to lower my fixed costs?

- Do I need to lower my variable costs? Are my raw materials too expensive? Is my staffing unsustainable?

Break-even analysis will allow you to determine what costs you'll need to cover to launch a new product and how to price it.

Knowing your BEV sales level and your optimal per-unit sales price will allow you to set long-term goals, such as how many more units you'll need to sell to cover the costs of expanding your manufacturing operations, for example.

Want to Learn More About Economics and Business?

Learning to think like an economist takes time and practice. For Nobel Prize-winner Paul Krugman, economics is not a set of answers—it’s a way of understanding the world. In Paul Krugman’s MasterClass on economics and society, he talks about the principles that shape political and social issues, including access to health care, the tax debate, globalization, and political polarization.

Want to learn more about economics? The MasterClass Annual Membership provides exclusive video lessons from master economists and strategists, like Paul Krugman.